Introduction

Build a Robo-Advisor with Python (From Scratch) by Rob Reider and Alex Michalka represents a comprehensive guide to automating investment management using Python. Published by Manning in 2025, the book bridges the gap between financial theory and practical implementation, teaching readers how to design and develop a fully functional robo-advisor from the ground up.

The authors, with backgrounds at Wealthfront and Quantopian, bring real-world experience to the material. The book targets finance professionals, Python developers interested in FinTech, and financial advisors looking to automate their businesses. It assumes basic knowledge of probability, statistics, financial concepts, and Python programming.

The book demonstrates how to build sophisticated features including cryptocurrency portfolio optimization, tax-minimizing rebalancing strategies (periodically adjusting portfolio holdings to maintain target allocations), and reinforcement learning algorithms for retirement planning. Beyond robo-advisory applications, readers gain transferable skills in convex optimization (mathematical techniques for finding optimal solutions), Monte Carlo simulations (using random sampling to model uncertain outcomes), and machine learning that apply across quantitative finance.

Notably, the authors acknowledge that while much content focuses on US-specific regulations and products (IRAs and 401(k)s—tax-advantaged retirement accounts), the underlying concepts are universally applicable. International readers can adapt these principles to their local equivalents, such as UK SIPPs (Self-Invested Personal Pensions) or other country-specific retirement vehicles.

Overall Approach to the Problem

Book Structure and Philosophy

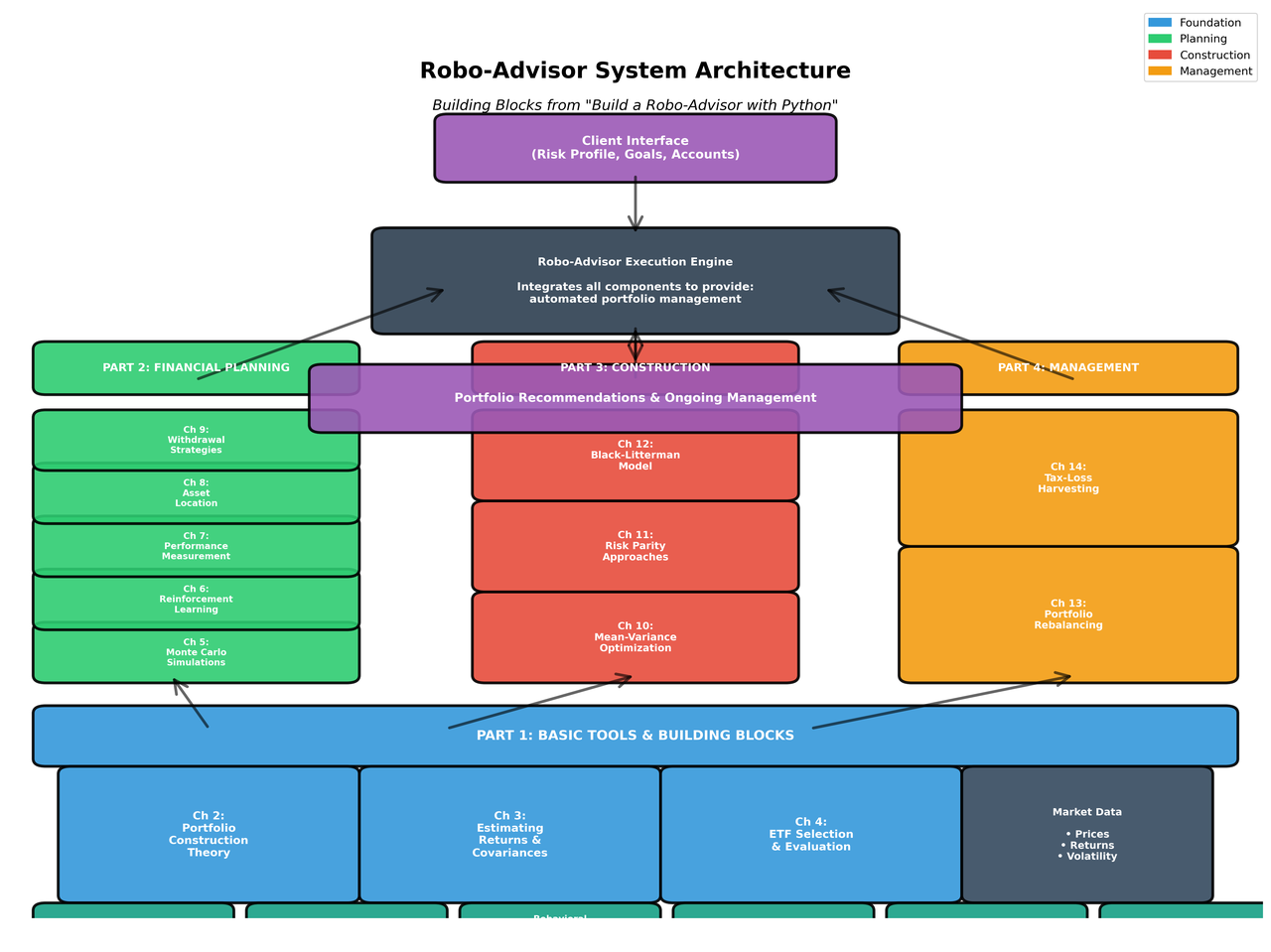

The book is organized into four interconnected parts, designed to be read sequentially for Part 1, with Parts 2-4 accessible in any order based on reader interest. This modular structure reflects the real-world architecture of robo-advisory systems, allowing readers to focus on areas most relevant to their needs.

Figure 1: Complete system architecture showing all four parts of the book and how they integrate into a cohesive robo-advisory platform.

The authors emphasize accessibility while maintaining rigor, noting that the book bridges foundational knowledge and practical implementation rather than teaching finance or Python from scratch. This positioning makes it ideal for readers with basic grounding in both domains who want to understand how they intersect in real-world applications.

Pedagogical Approach

The balance of theory versus implementation varies strategically by chapter. Some chapters focus heavily on financial concepts with minimal Python code, utilizing existing libraries. Other chapters are "code-heavy," where the authors essentially build new Python libraries from scratch to implement concepts without existing tools. All code is available via the book's GitHub repository and Manning's website.

The Building-Blocks Philosophy

The book first frames the robo-advisor landscape and the advantages of automation—low fees, tax savings through tax-loss harvesting (selling losing investments to offset capital gains), and mitigation of behavioral biases like panic selling and market timing. This establishes the "why" before diving into the "how."

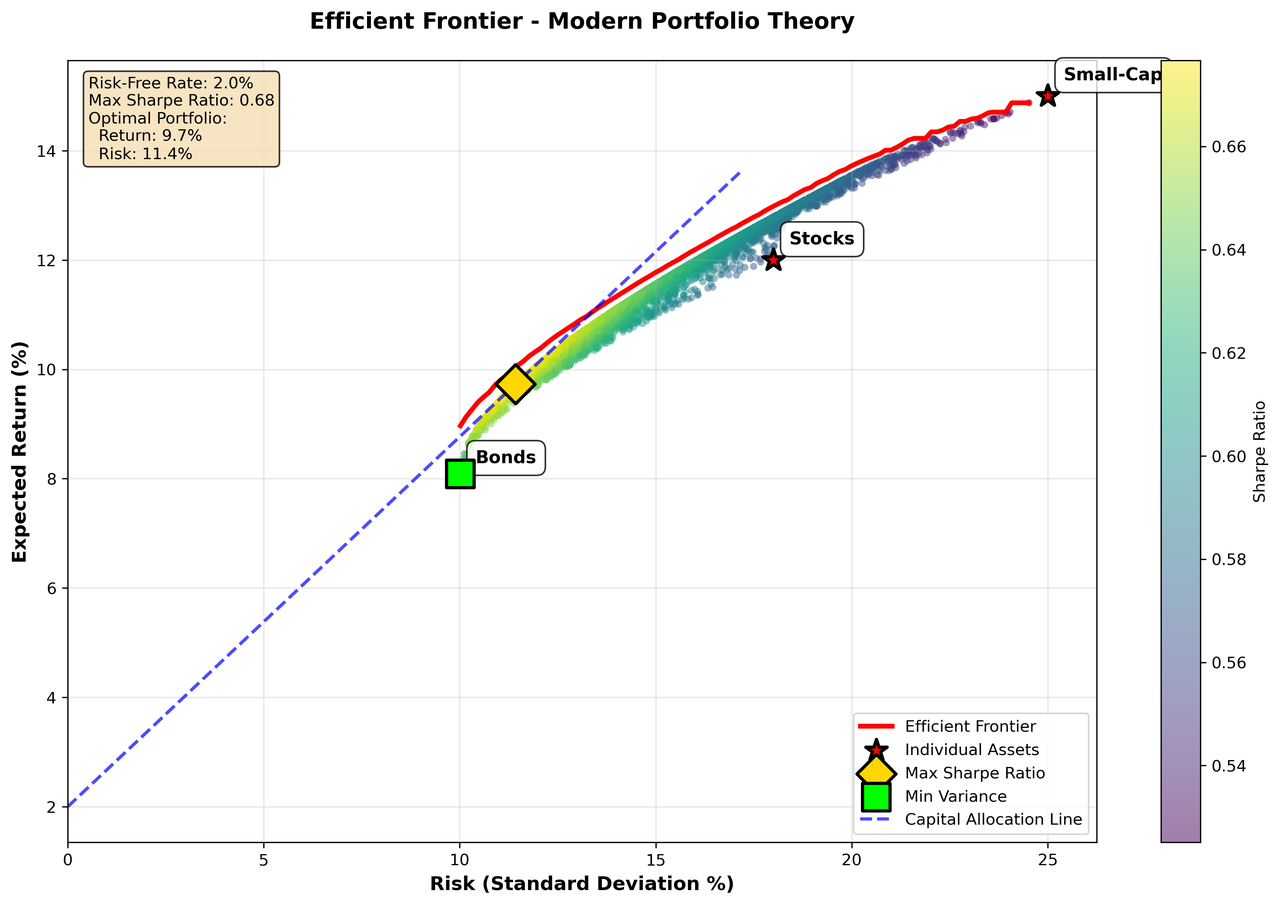

From there, the authors adopt a building-blocks approach: start with core financial concepts like risk-versus-reward plots and the efficient frontier (the set of portfolios offering maximum return for each level of risk) before moving to quantitative estimation of expected returns, volatilities (measures of investment price fluctuation), and correlations (how assets move in relation to each other). This progressive integration of data-driven tools, Python libraries, and ETF (Exchange-Traded Fund) selection culminates in a deployable advisory engine.

Technical Tools

The book leverages Python's scientific computing ecosystem, including convex optimization tools (likely CVXPY), statistical libraries (NumPy, Pandas, SciPy), and custom implementations where existing tools fall short. The authors aren't afraid to build from scratch when necessary, giving readers deep insight into algorithmic internals.

Real-World Considerations

The book addresses practical challenges often overlooked in academic treatments: trading costs and their impact on strategies, tax implications across different account types, required minimum distributions (RMDs—mandatory withdrawals from retirement accounts after age 73), state-specific tax considerations, inheritance planning, and capital gains management (taxes owed when selling appreciated assets). This attention to real-world complexity distinguishes the book from purely theoretical treatments.

Step-by-Step Build-Up

Part 1: Basic Tools and Building Blocks

The foundation begins with understanding why robo-advisors exist and what problems they solve. Chapter 1 contextualizes robo-advisors in the modern financial landscape, highlighting their key features: low management fees compared to traditional advisors, automated tax savings through tax-loss harvesting, protection against behavioral biases, and time savings through automation. The chapter provides a comparison of major robo-advisors and explicitly outlines what robo-advisors don't do, setting realistic expectations.

A practical example examines Social Security benefit optimization, demonstrating how robo-advisors can automate complex financial planning decisions. The chapter concludes by identifying target audiences: finance professionals seeking automation skills, developers entering FinTech, and financial advisors wanting to scale their practices.

Chapter 2: Portfolio Construction Fundamentals

This foundational chapter introduces modern portfolio theory through a simple three-asset example. Readers learn to compute portfolio expected returns (predicted average gains) and standard deviations (statistical measure of risk), understand risk-return tradeoffs through random weight illustrations, and grasp the role of risk-free assets (like Treasury bonds) in portfolio theory. The chapter establishes the mathematical foundation for later optimization work, introducing the efficient frontier concept and demonstrating how different portfolios plot on risk-return space. Readers generate their first frontier plots in Python, visualizing the theoretical concepts in concrete terms.

Figure 2: The efficient frontier showing optimal portfolios, with the maximum Sharpe ratio portfolio highlighted in gold and the capital allocation line extending from the risk-free rate.

Chapter 3: Estimating Key Inputs

This critical chapter tackles the challenging problem of forecasting future returns—arguably the most difficult and consequential task in portfolio management. The authors present multiple methodologies for expected returns: historical averages and their limitations, the Capital Asset Pricing Model (CAPM—a theoretical framework relating expected returns to systematic risk) for equilibrium-based estimates, adjusting historical returns for valuation changes, and using capital market assumptions from major asset managers.

For variances and covariances (statistical measures of how assets move together), the chapter covers historical return-based estimation, GARCH (Generalized Autoregressive Conditional Heteroskedasticity—a statistical model for time-varying volatility) models, alternative approaches for robust estimation, and incorporating subjective estimates and expert judgment. This chapter is essential because portfolio optimization is extremely sensitive to input assumptions—poor estimates of expected returns can lead to concentrated, risky portfolios.

Chapter 4: ETFs as Building Blocks

Exchange-traded funds (ETFs—securities that track indices or baskets of assets and trade like stocks) form the foundation of most robo-advisory portfolios. The chapter covers ETF basics including common strategies (market-cap weighted, equal-weighted, strategic beta), ETF pricing theory versus market reality, and costs including expense ratios (annual management fees), bid-ask spreads (difference between buy and sell prices), and tracking error (deviation from the index being tracked).

A detailed comparison of ETFs versus mutual funds explores tradability differences, cost structures, minimum investments, and tax efficiency advantages. The chapter provides a thorough analysis of total cost of ownership, going beyond simple expense ratios. It concludes by exploring alternatives to standard indices, including smart beta strategies (factor-based investing targeting specific characteristics: value, momentum, quality, low volatility) and socially responsible investing (ESG—Environmental, Social, and Governance considerations). Code for selecting and loading ETF price series completes the toolkit.

Part 2: Financial Planning Tools

Chapter 5: Monte Carlo Simulations

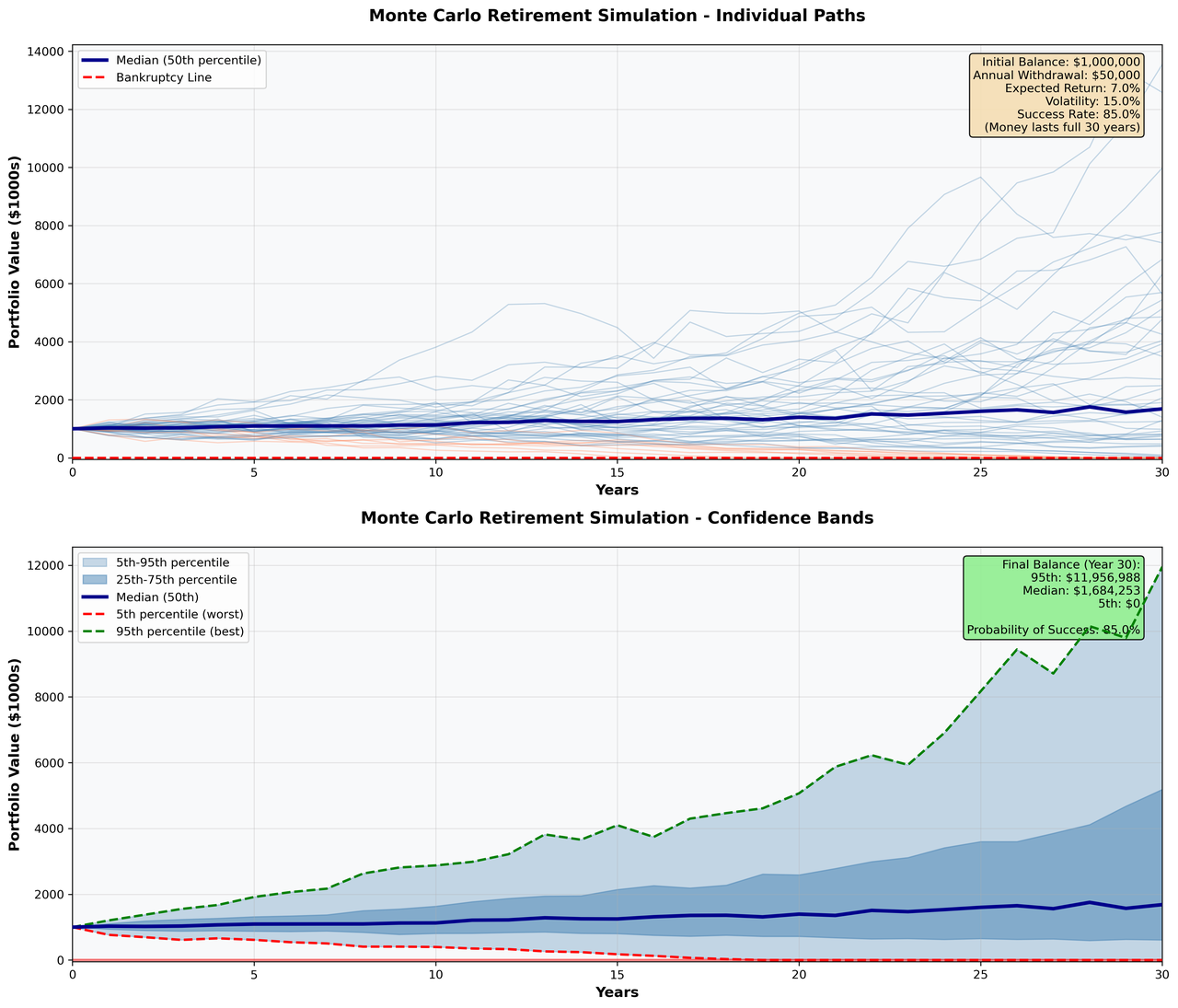

Monte Carlo methods enable probabilistic financial planning by simulating thousands of potential market scenarios. The chapter covers simulating returns in Python using random sampling, the crucial distinction between arithmetic and geometric average returns for long-term projections, and geometric Brownian motion (a mathematical model of random price movements) for modeling asset prices.

Readers learn to estimate probability of retirement success under different scenarios, implement dynamic strategies that adjust based on portfolio performance, and model inflation risk and its erosion of purchasing power. The chapter addresses fat-tailed distributions (probability distributions with higher likelihood of extreme events, like market crashes) and introduces historical simulations and bootstrapping (resampling from actual historical returns) from actual return sequences. Longevity risk (the risk of outliving one's savings) modeling rounds out the comprehensive treatment, emphasizing the flexibility of Monte Carlo approaches for modeling various risk sources simultaneously.

Figure 3: Monte Carlo simulation showing 100 potential portfolio paths over 30 years, with confidence bands illustrating the range of possible outcomes. This example shows an 85% success rate with a $1M initial balance and $50K annual withdrawals.

Chapter 6: Reinforcement Learning for Financial Planning

This innovative chapter applies machine learning to financial planning through goals-based investing examples. It introduces reinforcement learning concepts (a machine learning paradigm where agents learn optimal behavior through trial and error: states, actions, rewards, policies) and presents solutions using dynamic programming for optimal decision sequences and Q-learning (a model-free reinforcement learning algorithm) for situations where transition probabilities are unknown.

The chapter explores utility function approaches for capturing risk preferences, explaining risk aversion and diminishing marginal utility (the principle that additional wealth provides less incremental satisfaction). Readers implement optimal spending strategies that maximize lifetime utility while incorporating longevity risk. The reinforcement learning framework finds "glide paths" (asset allocation trajectories over time) that maximize how long retirement funds last while maintaining desired spending levels—a more sophisticated approach than traditional static withdrawal rules.

Chapter 7: Performance Measurement

Proper performance measurement is essential for robo-advisors. The chapter distinguishes between time-weighted returns (measuring portfolio manager skill independent of cash flows) and dollar-weighted returns (capturing actual investor experience including timing of contributions and withdrawals), explaining when to use each metric. It covers risk-adjusted returns including the Sharpe ratio (excess return per unit of volatility—a measure of risk-adjusted performance) and alpha (excess return relative to a benchmark after adjusting for market risk). A practical example evaluates ESG fund performance, and the chapter discusses which metric is superior for different contexts.

Chapter 8: Asset Location Optimization

Tax-efficient asset placement can add significant value—often 0.1-0.3% annually. The chapter uses simple examples to demonstrate tax location benefits, showing how the tax efficiency of various asset classes (bonds in tax-deferred accounts, stocks in taxable accounts) impacts portfolio returns.

Adding Roth accounts (tax-free retirement accounts funded with after-tax dollars) to the optimization problem creates a three-way decision across taxable, traditional IRA (tax-deferred), and Roth IRA accounts. Mathematical optimization approaches solve for the best asset location, with additional considerations for required minimum distributions, charitable giving, and potential tax rate changes. This sophisticated treatment goes far beyond the simple rules of thumb found in popular finance advice.

Chapter 9: Tax-Efficient Withdrawal Strategies

During retirement, withdrawal sequencing significantly impacts after-tax wealth. The chapter establishes two core principles: deplete less tax-efficient accounts first, and keep tax brackets stable over time to avoid pushing income into higher brackets.

Four sequencing strategies are compared: IRA first (traditional approach), taxable first (preserving tax-deferred growth), fill lower tax brackets (optimizing marginal rates), and strategic Roth conversions (paying taxes intentionally in low-income years). Additional complications include required minimum distributions forcing withdrawals after age 73, inheritance considerations for heirs, capital gains taxes on appreciated assets, and state tax differences. The chapter integrates all considerations into comprehensive strategies that can add substantial value over simplistic approaches.

Part 3: Portfolio Construction and Optimization

Chapter 10: Mathematical Optimization

This chapter introduces mathematical optimization for portfolio construction, starting with convex optimization basics in Python. Readers learn about objective functions (what to maximize or minimize), constraints (restrictions on solutions), decision variables (values the optimizer can change), and why convexity matters (it guarantees finding the global optimal solution rather than getting stuck in local optima).

Mean-variance optimization—the basic Markowitz problem of minimizing variance (risk) for a given expected return—forms the core. Adding constraints like no short sales (preventing bets against assets), position limits (maximum allocation to any single asset), and sector constraints makes the optimization more realistic. Optimization-based asset allocation explores minimal constraints approaches and enforcing diversification to prevent concentrated portfolios.

The chapter includes creating the efficient frontier and building ESG portfolios with values-based constraints. Importantly, it highlights pitfalls of optimization, including sensitivity to inputs and tendency toward extreme portfolios—critical warnings for practitioners.

Chapter 11: Risk Parity Approaches

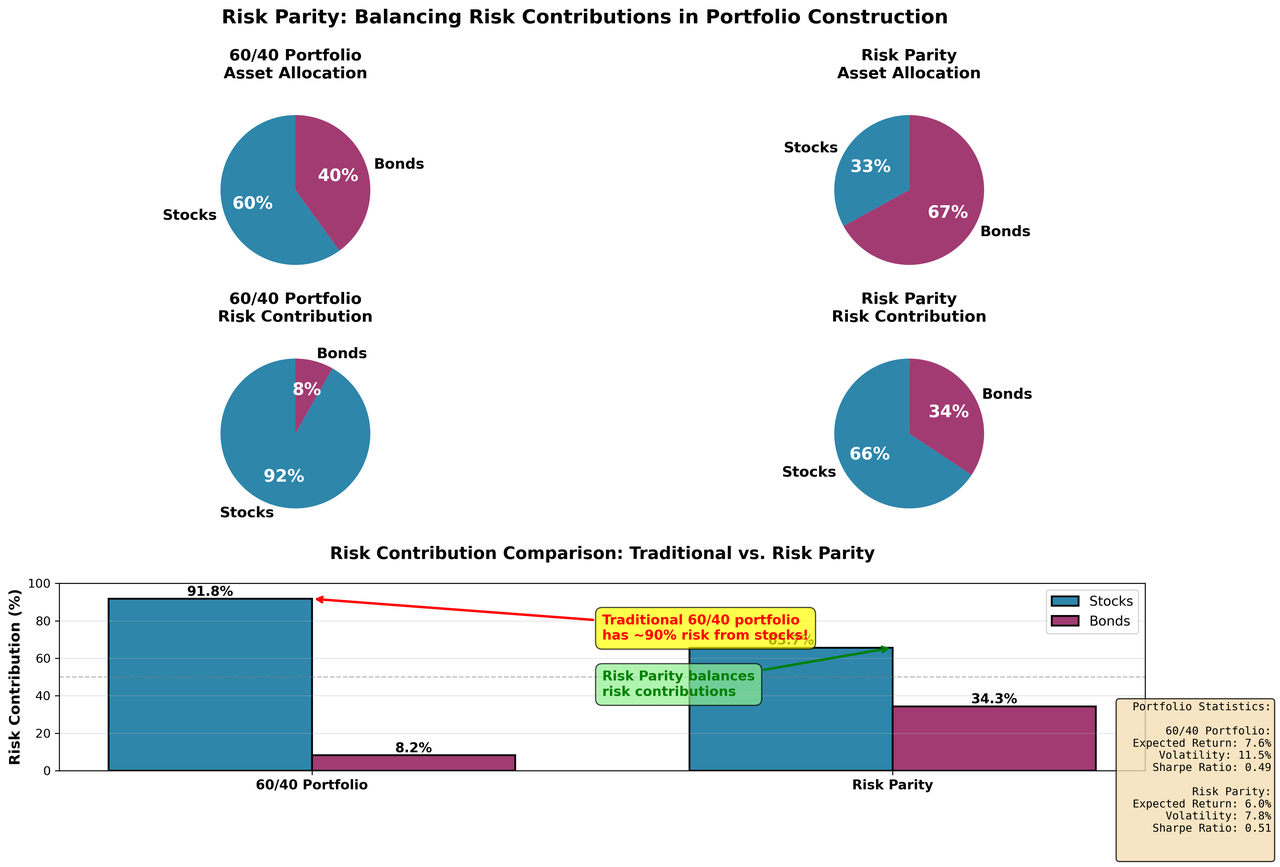

Risk parity offers an alternative to mean-variance optimization by focusing on risk contributions rather than dollar allocations. The chapter decomposes portfolio risk to show that "diversified" portfolios often have 70%+ of their risk coming from equities despite more balanced dollar allocations.

Risk parity as an optimal portfolio emerges under certain assumptions. The chapter covers calculating risk-parity weights through several approaches: naive risk parity (equal volatility contribution from each asset), general risk parity (equalizing risk contributions across all assets), weighted risk parity (customized risk budgets for different asset classes), and hierarchical risk parity (clustering correlated assets into groups before allocation).

Implementation considerations include applying leverage (borrowing to amplify returns) to achieve target returns and practical considerations for retail investors who may face constraints on leverage use.

Figure 4: Comparison of traditional 60/40 portfolio versus risk parity approach. Despite balanced dollar allocation, the 60/40 portfolio derives 92% of its risk from stocks, while risk parity achieves more balanced risk contributions.

Chapter 12: The Black-Litterman Model

This sophisticated approach combines market equilibrium with investor views through a Bayesian framework (statistical method for updating beliefs with new evidence). The chapter starts with equilibrium returns using reverse optimization—inferring implied returns from observed market weights—and explains market equilibrium concepts.

The Bayesian framework applies conditional probability and Bayes' rule to portfolio construction. Readers learn to express views as random variables, incorporate both absolute and relative views, update equilibrium returns with personal forecasts, and select appropriate assumptions and parameters like confidence levels.

Practical examples include sector selection with Black-Litterman and global allocation including cryptocurrencies. This cutting-edge technique allows robo-advisors to incorporate client preferences or expert forecasts while remaining grounded in market equilibrium—a powerful compromise between pure passive indexing (buying and holding market portfolios) and active management (attempting to beat the market through security selection).

Part 4: Advanced Portfolio Management

Chapter 13: Systematic Rebalancing

Maintaining target allocations over time requires systematic rebalancing as different assets generate different returns and drift from targets. The chapter explains the need for rebalancing while acknowledging downsides: trading costs, taxes, and time spent. It addresses handling dividends and deposits during rebalancing events.

Simple rebalancing strategies include fixed-interval rebalancing (trading on a set schedule like quarterly or annually) and threshold-based rebalancing (trading when allocations drift beyond specified tolerance bands). The chapter explores combining approaches and other considerations.

Optimizing rebalancing takes a more sophisticated approach, formulating an optimization problem with decision variables (trade amounts for each asset) and inputs (current holdings, target weights, prices, costs, tax rates). The objective minimizes tracking error (deviation from target allocation) plus costs plus taxes—a realistic multi-objective problem. Running practical examples demonstrates the approach.

Comparing rebalancing approaches requires implementing different rebalancers in code, building a backtester to evaluate historical performance, running systematic backtests, and evaluating results across multiple metrics. This empirical approach reveals which strategies work best under different market conditions and cost assumptions.

Chapter 14: Tax-Loss Harvesting

The book concludes with this powerful tax optimization technique. The economics of tax-loss harvesting include tax deferral benefits (accelerating the realization of losses while deferring gains) and rate conversion opportunities (converting ordinary income tax rates to lower long-term capital gains rates). The chapter explains when harvesting doesn't help, such as in tax-deferred accounts or for taxpayers with zero tax rates.

The wash-sale rule—an IRS regulation prohibiting loss claims on substantially identical securities purchased within 30 days before or after a sale—adds complexity. Implementing wash-sale tracking in Python and handling complexities across multiple accounts proves challenging but essential for compliance.

Deciding when to harvest requires evaluating trading costs and break-even thresholds, opportunity cost of switching securities, and using an end-to-end evaluation framework. Testing the TLH strategy involves backtester modifications for tax tracking, choosing appropriate replacement ETFs (correlated but not substantially identical), and historical performance evaluation. Studies suggest tax-loss harvesting can add 0.5-1.0% annually for high-income taxpayers in taxable accounts—a substantial enhancement to after-tax returns.

Critical Evaluation

Strengths

The book's greatest strength lies in its practical, implementation-focused approach. Unlike purely theoretical finance texts, Reider and Michalka provide complete, working code that readers can immediately apply. The GitHub repository with chapter-by-chapter implementations represents substantial value for practitioners who want to see theory translated directly into functioning software.

The modular structure allowing Parts 2-4 to be read independently shows thoughtful organization. Readers with specific interests can focus on portfolio construction, financial planning, or portfolio management without wading through irrelevant material. This flexibility acknowledges that different readers bring different backgrounds and have different goals.

The authors' real-world experience at Wealthfront shines through in chapters on tax-loss harvesting and rebalancing optimization. These topics receive sophisticated treatment often absent from academic texts, addressing practical concerns like wash-sale tracking and transaction cost modeling. The attention to tax optimization throughout the book—asset location, withdrawal sequencing, tax-loss harvesting—reflects real-world priorities where after-tax returns matter most to clients.

The inclusion of modern techniques—reinforcement learning for financial planning, hierarchical risk parity, Black-Litterman models—demonstrates the book's currency with contemporary quantitative finance. Readers gain exposure to cutting-edge methods actively used by leading robo-advisors, not just textbook theory from decades past.

Weaknesses

The US-centric focus on tax regulations and retirement accounts limits international applicability. While authors acknowledge this limitation, significant portions of Chapters 8-9 and 14 require adaptation for non-US readers. International practitioners will need to translate IRA rules to their local equivalents, understand their country's wash-sale or substantially identical security rules, and adapt tax optimization strategies to local tax codes. The prerequisite assumption of "basic understanding of probability, statistics, financial concepts, and Python" may be too vague. Readers lacking strong foundations in any area might struggle, particularly with more advanced chapters on GARCH models or reinforcement learning. Though the authors partially mitigate this through accessible explanations, some readers may need supplementary resources. Some advanced topics receive relatively brief treatment given their complexity. GARCH models for volatility forecasting and reinforcement learning frameworks are sophisticated techniques that typically warrant book-length treatments of their own. While the introductions suffice for building working implementations, readers seeking deep theoretical understanding will need additional resources. The book's focus on ETFs as building blocks, while pragmatic for most robo-advisors, limits applicability for readers working with individual securities, options, or alternative investments. The techniques generalize, but concrete examples use ETF-based portfolios throughout.

Overall Assessment

Despite minor limitations, the book represents an excellent resource for building real-world robo-advisory systems. The combination of financial theory, algorithmic implementation, and practical considerations makes it valuable for both practitioners building systems and learners seeking to understand how modern automated investment platforms work. The authors' decision to provide complete code examples and emphasize real-world challenges—taxes, costs, regulations—distinguishes this from more academic treatments that optimize elegant mathematical problems disconnected from implementation realities.

Conclusion and Recommendation

Build a Robo-Advisor with Python (From Scratch) successfully bridges the often-wide gap between financial theory and practical implementation. Reider and Michalka have created a comprehensive roadmap for developing sophisticated automated investment management systems using modern Python tools. The book's layered approach—starting with foundational portfolio theory, progressing through financial planning automation, advancing to portfolio construction techniques, and culminating in ongoing portfolio management—mirrors the actual architecture of production robo-advisory systems. This isn't just a collection of disconnected techniques; it's a coherent framework for building real systems. Beyond its immediate application to robo-advisory development, the book imparts valuable skills in optimization, simulation, and machine learning applicable across quantitative finance. The complete code repository and authors' commitment to ongoing engagement through their blog at pynancial.com enhance the book's long-term value as both reference and learning resource. For finance professionals seeking to automate investment processes, Python developers entering FinTech, or anyone interested in the intersection of finance and programming, this book offers substantial practical value. The authors have successfully created a resource that is both technically rigorous and immediately applicable to real-world investment management challenges. Whether you're building a full robo-advisor or just seeking to understand how modern automated investment platforms work, this book provides an excellent foundation and practical toolkit for success.